May 12, 2022

What the hell is “The Satanic Temple”? — Ep. 5: The Satanic Temple (Inc.)

The Satanic Temple has described itself in a variety of ways over the years, some of them contradictory.

However, since 2019, it would be fair to say that the Temple most commonly has described itself as a “famous IRS-recognized atheistic religious organization“, and this is how TST wants people to think of them.

What they’re referring to when they make this claim is not any of the other corporations in this “constellation of affiliate entities” that we’ve covered so far, but just one in particular: The Satanic Temple (Inc.)

Let’s do a quick recap: In the beginning, March 2012, there was a New York-based, Spectacle Films Inc. prank documentary project intended to follow in the style of “the Yes Men” about a non-existent organization that worshipped a supernatural Satan while doing good works, e.g. cleaning up a highway. In time, this project evolved into something larger than a fake organization and without a fixed end-date, becoming atheistic and supposedly sincere along the way.

In February 2014, one of the key figures in that documentary, Doug Misicko, registered the for-profit corporation “United Federation of Churches LLC” in Massachusetts, but its doing-business-as name and most of its trademarks were “The Satanic Temple”.

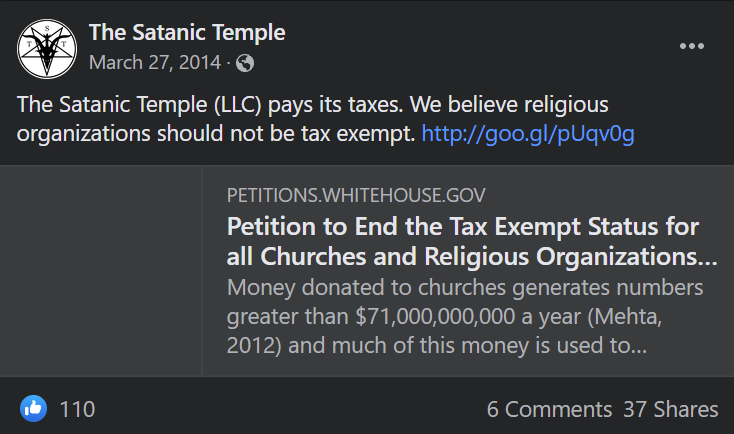

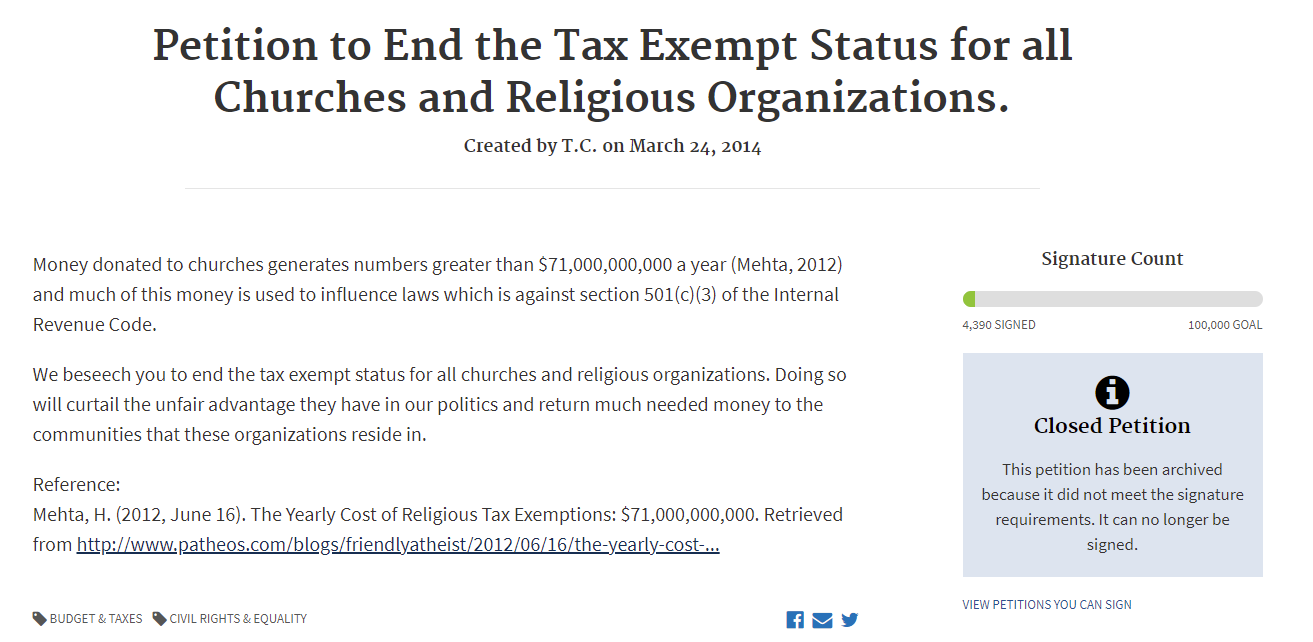

Now, still at this early point, the Temple took the stance that churches should not be tax-exempt.

This was similar to the older, unrelated organization the Church of Satan of Anton LaVey and its long-held public stance that churches should be taxed for income and property.

Yet, a few months later in September 2014, Misicko registered Reason Alliance Ltd., a standard, non-religious 501(c)(3) nonprofit.

This nonprofit grew to ultimately process hundreds of thousands of dollars annually in tax-exempt contributions, but that came with a downside: financial transparency.

An organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either Form 990PDF, Return of Organization Exempt from Income Tax, or Form 990-EZPDF, Short Form Return of Organization Exempt from Income Tax. …

Small organizations – those whose annual gross receipts are normally less than the threshold- are not required to file an annual return, but may be required to file an annual electronic notice – e-Postcard.

IRS.gov: Exempt Organization Annual Filing Requirements Overview

As discussed last time, it became obvious upon review of these documents that Reason Alliance Ltd. was at first explicitly then implicitly revealing it routed funds back to the for-profit by then owned by both Doug Misicko and Cevin Soling.

(At this point it becomes necessary to point out that both men are rather fond of using pseudonyms, including on government documents. Misicko also uses “Doug Mesner” and “Lucien Greaves”, the latter itself being a trademark of United Federation of Churches, LLC. Cevin Soling has also used “Calvin Soling,” but more often uses “Malcolm Jarry” for TST-associated business.)

This is something of a problem because, as other court depositions and evidence gathered in discovery have confirmed, “Reason Alliance / TST” money was being used to compensate at least one of the owners, Misicko, as needed. Yet, this was being hidden by putting payments on Spectacle Films invoices as late as 2017, or by first mixing it in the for-profit United Federation of Churches LLC general fund, which Misicko dipped into for rent, business expenses, or to “stay afloat” as needed – albeit with no outside accountability, since the only officers of any of these corporations were Misicko, Soling, or their pseudonyms.

The state of Arkansas described this as “a shell game“. Later depositions would reveal that yes, the two men considered funds in one entity to be entirely fungible with the funds of another, regardless of any difference in tax status between the two.

It is in this context that the advent of “The Satanic Temple (Inc.)” must be placed, and why that little parentheses will be even more important later.

As of 2022, when The Satanic Temple wants you to think of The Satanic Temple, they usually want you to think of “The Satanic Temple (Inc.).” That’s because it works out for them far better for you to imagine a nonprofit Satanic church, than for you to imagine any of the other, similarly-named entities that Soling owns, that do business as a variation on “The Satanic Temple.”

We have the aforementioned “United Federation of Churches LLC,” which is most egregious because its doing-business-as name is identical to the name that the nonprofit church used when applying to the IRS.

It was not until after getting IRS recognition as a tax-exempt church in February 2019 that three months later “The Satanic Temple” updated its name to “The Satanic Temple, Inc.”

This is why so many places, such as Amazon Smile, GuideStar, or the IRS itself refer to the nonprofit church as “The Satanic Temple”, full stop.

Which is a neat trick, isn’t it?

These two entities—a for-profit corporation and a nonprofit church—share a name, owners, the same website, same physical address, are used interchangeably by the organization itself, and apparently even funding.

One begins to think that the confusion is not just an unforeseen consequence of the way they sloppily set all this up but rather the very point of it.

Just look at this page on their site, the only place that “United Federation of Churches LLC” seems to appear at all.

For the casual observer or supporter, it is thus extremely easy to overlook the difference between donations to nonprofit church “The Satanic Temple Inc.” and merchandise purchased from for-profit business “The Satanic Temple,” because there is almost nothing on the site to suggest that there is a difference at all.

It is only the lack of this little note that lets you know you’re buying from the for-profit, which includes mugs and T-shirts, but also membership cards.

It is of course, not restricted to just these two.

- “Reason Alliance Ltd.” shows up in searches for “The Satanic Temple” and lists itself on invoices as “Reason Alliance / TST” – but is not The Satanic Temple Inc.

- “64 Bridge LLC” does business as “Salem Art Gallery” and seems co-extensive if not synonymous with “The Satanic Temple of Salem” — but is not The Satanic Temple Inc.

- “Cinephobia LLC” owns and operates “The Satanic Temple TV” — but it is not The Satanic Temple Inc.

- “Winstonian Enterprises Ltd.” was first described as “a third-party platform and is not affiliated with TST” and is now described as “a small company affiliated with The Satanic Temple which operates The Satanic Estate and its properties including The Satanic Temple Virtual Headquarters” — but it is not The Satanic Temple Inc.

(Note: These are just the corporations sharing the name that we know of.)

But if you don’t realize these distinctions, these largely for-profit companies are perfectly happy to let your misconceptions remain.

Meanwhile, there is no indication that nonprofit donations to “The Satanic Temple (Inc.)” are even segregated from any of these for-profit companies or their owners’ private use.

When we say, “No indication,” what we mean is that there are some announcements of total revenue received and laborious attempts to count donations using a third party like Facebook or Amazon, but otherwise there is no ability to track how much money is going in or how it is being spent.

To be clear, it is not illegal to not be transparent about those finances as other nonprofits are required to.

This lack of a disclosure requirement is one of the most important advantages of a church over some other kind of nonprofit.

Yet, many churches choose voluntarily to report their finances, publicly but especially to their own members, in order to maintain trust and accountability. It is an expectation from members for them to continue contributing.

But here, in addition, we have the statements of the owner when put under oath in TST v. Scottsdale, TST v. Belle Plaine, and Cave v. Thurston. When pressed on how money is being kept apart, the owners admit that they leave that stuff up to others, or even that they see no distinction between the for-profit monies they pay themselves with and the supposedly nonprofit monies used to do their charitable works.

Finally, in their lawsuit against us, The Satanic Temple continues to refer to itself as “a religious organization” even while choosing to utilize the for-profit corporation “United Federation of Churches LLC” as the plaintiff.

Yet, thanks to the Federal Employer Identification Number associated with it, we know it was The Satanic Temple (Inc.) that attempted to fundraise $30,000 to cover their SLAPP suit’s own costs in a GoFundMe.

What “The Satanic Temple (Inc.)” allows for, in other words, is to get another layer of financial obfuscation, another entity to shift money to, and another way to hide from donors, regulators, and litigants what is going on with all of those hundreds of thousands of dollars rolling around.

Postscript

The CBS/Paramount+ show “Evil” did an episode in its second season looking at an—entirely fictional!—organization called the “New Ministry of Satan.”

We’ll probably need to do a closer reading of that episode at some point, but something worth calling out is this requirement of nonprofit churches.

The net earning may not inure to the benefit of one person.”

In a much longer document, the IRS says:

Churches and religious organizations, like many other charitable organizations, qualify for exemption from federal income tax under IRC Section 501(c)(3) and are generally eligible to receive tax-deductible contributions. To qualify for tax-exempt status, the organization must meet the following requirements (covered in greater detail throughout this publication):

• the organization must be organized and operated exclusively for religious, educational, scientific or other charitable purposes;

• net earnings may not inure to the benefit of any private individual or shareholder;

• no substantial part of its activity may be attempting to influence legislation;

• the organization may not intervene in political campaigns; and

• the organization’s purposes and activities may not be illegal or violate

fundamental public policy.

What jeopardizes this tax-exempt status?

All IRC Section 501(c)(3) organizations, including churches and religious

organizations, must abide by certain rules:n their net earnings may not inure to any private shareholder or individual;

• they must not provide a substantial benefit to private interests;

• they must not devote a substantial part of their activities to attempting to

influence legislation;

• they must not participate in, or intervene in, any political campaign on behalf of

(or in opposition to) any candidate for public office; and

• the organization’s purposes and activities may not be illegal or violate

fundamental public policy.

What we’ve hopefully done a good job of showing here is that despite all of the pseudonyms and shell companies, there is lots of evidence based on the previous nonprofit Reason Alliance Ltd. and court documents that the owners of The Satanic Temple are anything but careful in terms of making sure they aren’t inuring the benefits of all these tax-deductible contributions that people think are going to protecting abortion rights and what have you.

When you point this out, some people are horrified, naturally. But for too many people, negative partisanship motivates their response, and what they revert to is some variation of, “What? You think any other organized religion is any better?”

This is actually the sort of cynicism that leads conservatives to support repugnant figures like Donald Trump and tactics like electoral fraud, no matter how egregious. “Yes, our guys are bad. But it’s nothing like the other guys.”

Yeah, if your baseline is, “Everything terrible the Catholic Church and billions of people have done for hundreds of years”, you will never have to grapple with the harm your own neo-religion or organization is doing. NXIVM and Scientology can’t hold a candle to the Holy See.

But is that really the standard you want to be using? Is that an improvement?

The Satanic Temple is competent as vehicle for the self-aggrandizement of Douglas Alexander Misicko (“Lucien Greaves”), as a vehicle for the pet projects of Cevin Soling (“Malcolm Jarry”), and as a money-generating machine. Literally nothing else.

Yes, it could be worse.

But when it comes to The Satanic Temple, there is always more and it is always worse.

The Satanic Temple's Boogeyman

Queer Satanic

TST sued us from April 2020 to September 2024, and we are still here.